arizona estate tax laws

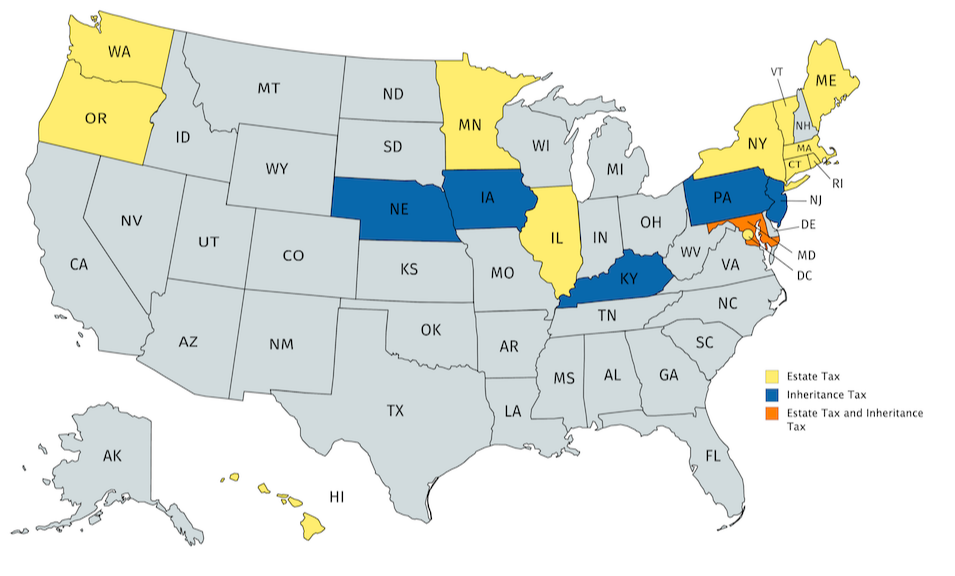

In the US there are only 12 states plus the District. Property and real estate law includes homestead protection from creditors.

Estate Planning Lawyer Chandler Arizona Citadel Law Firm

For tax years ending on or before December 31 2019 Individuals with an adjusted gross income of at least 5500 must file taxes and an Arizona resident is subject to tax on all income.

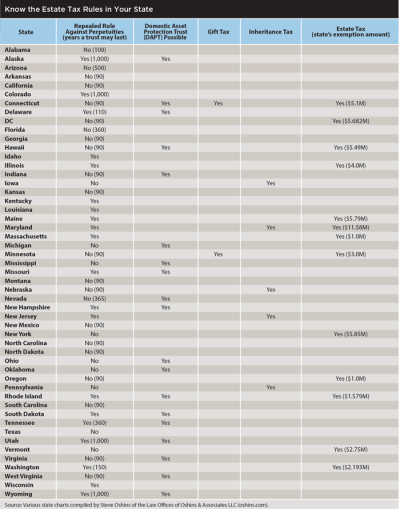

. Entire Arizona Revised Statutes. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. Laws 1937 Chapter 27 repealed the Arizona Inheritance Tax and authorized the Arizona Estate Tax in its place.

Whereas most states will categorize estate property depending on who specifically owns it Arizonas community and separate property laws muddy these waters a bit. Relationships between landlords and tenants. The federal estate tax still applies to Arizona residents however.

There is one exception to this rule which is for estates with personal property valued at less than 75000 and real property under 100000. Arizona Department of Revenue 602 255-3381 1600 West Monroe Street Phoenix AZ 85007. Economic Recovery Tax Act of 1981.

THIS TITLE HAS BEEN REPEALED. In the absence of a will state probate court decides. No tax is due unless the amount exceeded the lifetime exemption.

Chapter 11 - Property Tax. State revenues are comprised of property taxes sales tax and certain taxes on businesses. Laws 1982 Chapter 2 changed the Arizona Estate Tax Laws to conform with certain changes in the Federal Estate Tax Code passed in the US.

In Arizona as in other states ones estate is inherited by friends relatives or other beneficiaries according to the details in the written will. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. The Estate Tax was levied on the net estate of every decedent at the following.

In this case it is known as a small estate. Federal law eliminated the state death tax credit effective January 1 2005. 1 2005 Arizona no longer imposes an estate tax.

Arizona Property and Real Estate Laws. As of Jan. Statutes are laws passed by the Arizona Legislature.

Form 709 gift tax return must be filed to show the 5000 amount over the exemption. The majority of statutes relating to property tax are referenced in Title 42 Taxation. In Arizona as of 2022 all property is taxable unless exempted under the laws of the United States in Title 42 Chapter 11 Article 3 of Arizonas Revised Statute or laid out in.

Additionally states levy extra taxes on items such as liquor tobacco products and gasoline.

Estate Tax Planning In Arizona Inhertence Tax Plans Arizona Law Doctor

Wealthtrust Arizona Preparing For The Death Of A Loved One

Arizona Estate Tax Everything You Need To Know Smartasset

5 Things You Should Know About Probate Law In Arizona

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Amazon Com Brian Winter Tax Law Law Books

State Corporate Income Tax Rates And Brackets Tax Foundation

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

State Estate And Inheritance Taxes Itep

Is There An Inheritance Tax In Arizona

Arizona Vs Nevada Which State Is More Retirement Friendly

Arizona Estate Tax The 1 Way To Avoid

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Arizona Estate Tax Everything You Need To Know Smartasset

Estate Planning Update Financial Planning Association

Estate Planning Lawyer Mesa Gilbert Az Rowley Chapman Barney Ltd

State Taxes On Inherited Wealth Center On Budget And Policy Priorities